|

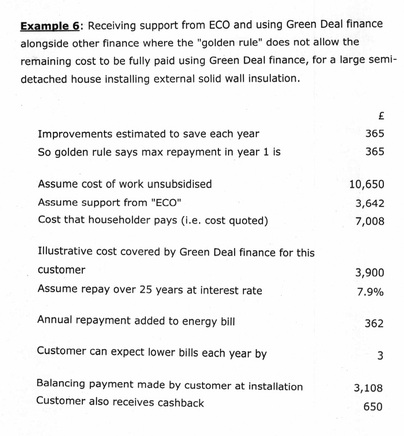

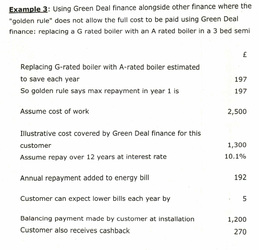

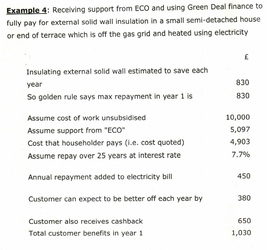

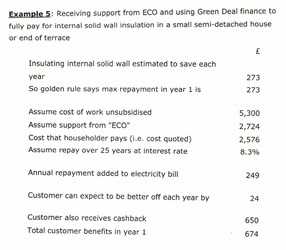

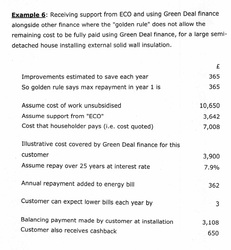

This blog post is inspired by an email from Stewart Gilmour, CIBSE Director of finance and Services, quoting the Chief executive of the Green Deal Finance Company (GDFC) Mark Bayley who said the interest rate was very competitive already: “If you take a typical finance for a boiler over several years, you are looking at 19% and ours is less than 9%.” Compared to the Bank of England base rate of 0.5%, 9% does not sound competitive at all, does it? In Germany, a similar 'pay as you save' scheme as the Green Deal was hugely successful with the energy-efficient improvement of about 1 million existing homes between 2006-2009. It achieved this with low interest (subsidised) loans and performance targeted subsidies (full report by UCL Energy Institute and LSE here). The interest rate was 3-5% fixed rate for ten years, and no early redemption penalties. Given the high quoted Green Deal interest rates and the difficulty to get a Green Deal Finance Plan, we decided to try to finance our GD interventions another way (i.e. part savings, part personal loan). We cannot remortgage before 2016 as we are in a fixed rate, so we cannot release 'cheap' money this way like some others can; nor does our bank offer a low interest rate loan for energy efficiency improvements, as offered by Nationwide at below 3% interest rate for existing mortgage holders. Yet Bayley may not have been so incorrect stating that the 9% rate is "competitive". While many advertised bank loan rates are around 5-6% (assuming good credit; more like 14-15% with fair credit); the less money you borrow, the higher the interest rate. For example, if you do not hold a Nationwide mortgage and are borrowing with a standard personal loan instead; < £5000 from Nationwide will attract 11.9% interest; while between £5000 and < £7500 this is 8.9% and the lower advertised rate of 4.9% does not kick in until you borrow > £7500. Most loans work this way. And these are quite good rates for small amounts of money, for example the Bank of Scotland's rate for < £5000 is as much as 19.5%; though the cheapest I could find for this amount was Zopa (peer to peer lending) with 6%. With personal loans, the payback is usually ≤ 5 years, while for the Green Deal this can be spread over a longer term, with a minimum of 10 years, ofcourse building up proportional interest accordingly (see later). As this is paid back through the energy bills, selling your house would in effect pay off 'your' loan, by passing it to the next homeowner with the house sale, unless you need to pay it off early to find a buyer; there are likely to be early repayment redemption penalties for GD loans. Example 6, courtesy of DECC*, below highlights that repaying £3900 over 25 years at an assumed interest rate of 7.9%, will result in a total cost to be paid back of around £9000, with £362 annual repayments, or around £30 per month. However, if you can afford a higher repayment of £85 per month, you are better off taking the Nationwide loan, even at nearly 12%, as you'd paid back a total of £5100 after 5 years for the initial borrowed £3900. So, is the 9% Green deal rate competitive? Depends how you look at it and what other access to money you have and how much you can afford to repay each month. It is indeed a good thing that there are other incentives to bring costs down for those on low incomes. As our Green Deal Assessor said at her visit: "you may find that borrowing under the Green Deal Finance Plan is not the best way to fund the improvements, so look around." This advice is sound, it seems!

* As stated on first page; these examples are for information only and not for financial advice. All 6 examples below.

7 Comments

Sofie Pelsmakers

9/16/2013 06:34:51 am

Hi Linn, thanks for the comment! Ofcourse depending what you compare the GD interest rate against, it is 'good' or 'bad' - it is all relative. But I am sure you'd agree that we shouldn't be comparing the GD loan rate to payday loan rates - ofcourse the GD rate looks like a 'brilliant' deal if we compare it against those kinds of loans, when it is not 'brilliant', particularly when borrowing over a long period of time. It is also concerning that people with no easy access to money and with no good credit rating, can borrow cheaper through the GD finance plan, but are still paying a lot more than those with access to alternative funds who can borrow elsewhere outside the GD finance plan. Over a 25 year loan the disadvantages of the GD interest rate really adds up - my main concern being that ultimately the money being spent on ACTUAL improvements is therefore reduced to meet the Golden Rule. It is clear that if you can borrow from somewhere else at a lower rate(say through mortgage) or a personal loan paid back over a few years - this will give a much quicker payback of the measures installed.

Reply

@linniR

9/16/2013 09:14:46 pm

hi Sophie

Sofie Pelsmakers

9/16/2013 09:25:21 pm

agreed!

Reply

Richard Snape

9/16/2013 09:45:25 pm

The question I like to consider on this point is this - "Who is likely to look to Green Deal finance to fund this kind of work?". A related question, which I won't address here, is "Who is likely to consider doing this kind of work?". I rather suspect (with no hard evidence - in contrast to my usual penchant for statistics) that the people who have the assessment and consider the financing options will, in the main, be relatively rich and middle class - like the commentators @linniR mentions. I think this is a fundamental problem for the scheme. My view is that any kind of deal that requires borrowing for up front investment will tend to benefit the middle class. If you are worried about day-to-day expenses, I don't think you will want to take out a loan (seen as additional expense in the short term) to finance a "nice-to-have" investment such as insulation, which from the perspective of a bill payer today may or may not pay back. I also suspect that those who might benefit most from a 7% rate are disproportionately represented in housed in housing where they are not at liberty to make alterations to the building fabric.

Reply

Anthony Breslin

9/18/2013 08:34:04 pm

i found this paper interesting when i was looking at green deal take up barriers before it 'started' (Holmes, I., 2011, Financing the Green Deal Carrots, sticks and the Green Investment Bank [Online], E3G, Available at: http://www.e3g.org/images/uploads/E3G_Financing_the_Green_Deal_May_2011.pdf)

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

About SofieThis is Sofie's blog; or rather a collection of musings & articles sometimes also published elsewhere. More about Sofie here. Archives

April 2014

Categories

All

|

RSS Feed

RSS Feed