|

Despite months of preparing and chasing to get a Green Deal since March 2013, our actual Green Deal installation happened to coincide with my main PhD research in winter 2013/14. This meant I did not manage to blog about the process as we went along; but I did end up taking many pictures - often once the installer had left for the day and I returned from my fieldwork. It also meant that I missed out on being there for several crucial stages. For example it was my husband who was around when Instagroup came to inspect the works on two occasions; when the window cills were measured and installed and reveals insulated (only very few); when the insulation was mechanically fixed and gaps filled; the eaves capping was installed and I was also not present when the services were finally insulated and boxed in nor when the rendering and painting took place. Being unable to witness and influence the Green Deal installation process is definitely frustrating as an architect (and when knowing a thing or two about thermal bridging), though it probably prevented me from becoming the 'client from hell' by interfering. As such I do think that our experience and installation is probably fairly typical of a Green Deal installation and I will write another blog about some issues with standard detailing and trying to find solutions with the installer (who were as flexible as they could be within the constraints of Instagroup's EWI system and Green Deal approval). Actually, I bet you can identify some of these issues and (potential) problems from some of the photographs below, without my commentary? Do leave comments! Roof insulation and waterproofing (not Green Deal)The existing roof basically was just some asphalt on timber boards over timber joists. You can see here where the previous owner had the chimney removed and had run a new piece of asphalt across this gap! On the right is the new roof on top of the old: 18 mm OSB + vapour barrier + 100mm ECOTHERM insulation board (k=0.025 W/mK) + underlay + waterproofing. The new timber edge is to enable the 100 mm insulation and the roof also overhangs by ~ 150 mm over the wall to meet the 100 mm EWI at later stages, avoiding typical EWI Green Deal capping systems for most of the roof - see pictures. NB: We will still need to insulate in between the joists from the ceiling at some point,... EWI installation processOur Green Deal process has finished exactly a year later - and we have just submitted paperwork for our cashback. Firstly, scaffold was installed in late November to enable flat roof insulation and new waterproofing, a process which took < 1 week. In early December, the scaffold was adjusted further away from the walls to allow for future EWI installation and things initially took off quickly. However, soon delays occurred due to darkness setting in sooner at that time of year and on many occasions the guys on site had to wait until temperatures were > 5ºC and rising to glue the insulation to the walls. As a result the works did not finish before Christmas and New Year 2013, and around this period much of the UK witnessed extreme weather leading to further delays on site: rendering and painting can only happen when there are several days of dry weather so there were several weeks where nothing could happen. A few Green Deal installers told me that they had been under pressure to render several houses to finish on time (before the cash-back ran out or ECO would be scrapped) and overnight rain washed the render away and it had to be all scraped off and redone at another time - so things could have been worse I guess! Our window cills also took almost 2 months to arrive! EWI installation stagesNB: I will be taking some InfraRed images too and will post them here at some stage,...

5 Comments

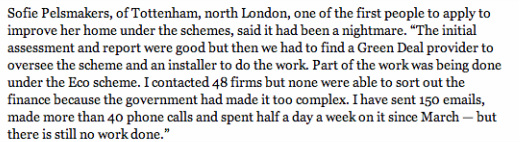

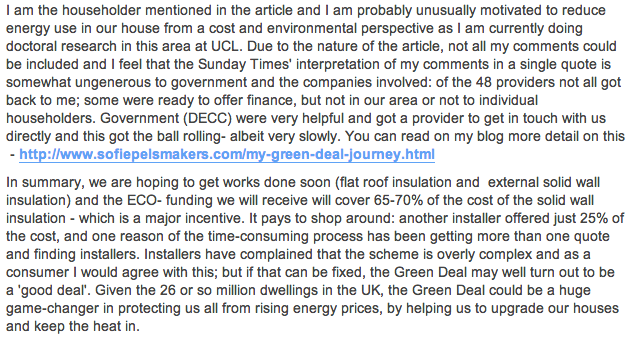

The Sunday Times printed a brief 'quote' today of a much longer conversation (over 30 minutes + 2 follow-up emails) I had with their journalist Jonathan Leake on Friday 18th September. When the journalist called me, he said that most in industry he had spoken to said that the Green Deal has great potential but that in its present form it is too complex. I agreed with him. We discussed the process and I gave several examples of the complexity of the scheme, but I also said that DECC Green Deal team had been very helpful and got the ball rolling and that we now had quotes offering a large proportion of the works to be funded under ECO. Yet the final article ends up pretty negative about the Green Deal with no mention of the 'potential' of the Green Deal, nor its necessity. Below is the Sunday Times' 'quote': Obviously the space in the article is limited, but I think it is unfortunate that only the negatives are focused on. This is my comment left to the Sunday Times and its readers:

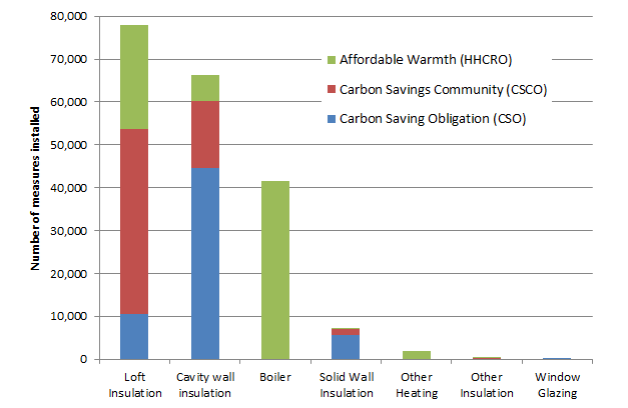

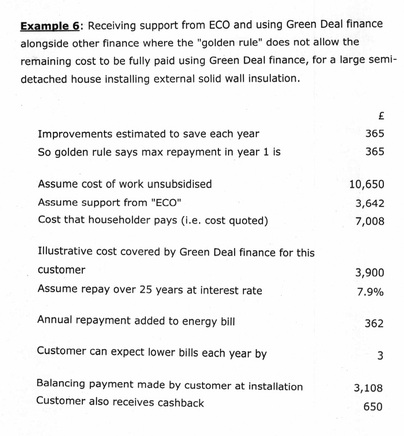

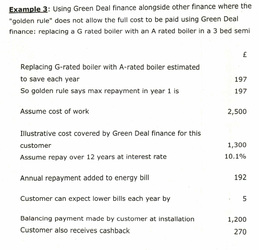

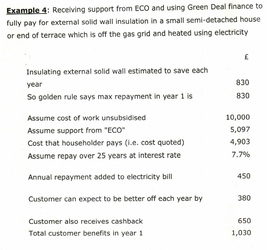

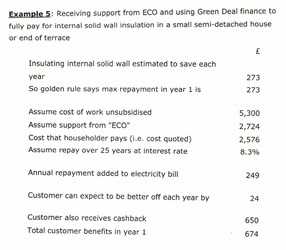

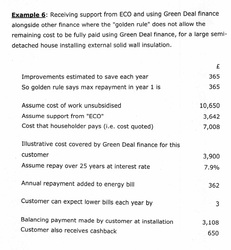

A lot has been made in the media and in politics that the Green Deal has not taken off and there are suggestions from some quarters that it should be scrapped. Readers of this blog will know about my own criticism and issues encountered with the Green Deal for my own house. So far there are ’12 Green Deal Plans’, which I understand are the households currently having had their measures installed, but 677 were in the system since the end of August. This would exclude our GD plan and many others presumably. As time progresses, more plans will have been installed; but these numbers are still in stark contrast with the 71,000 GD assessments so far undertaken. Though this disjunct may be partially explained by the fact that the figures above do not include householders choosing to act outside the GD. More impressively however is that by the end of July there had been ~ 196,000 ECO measured installed, benefiting 173,000 households. Most of this was loft insulation(40%), cavity wall(34%) and boiler upgrades(21%) with just 4% solid wall insulation installations, as is illustrated in DECC's graph below. Reducing carbon emissions associated with domestic space heating is a key aspect to meet the UK Government’s overall emission reduction targets of 80% from 1990 levels by 2050 (Crown, 2008). Given that 7.8 million of 26.7 million dwellings in Great Britain are solid walled dwellings (DECC, 2012) and roughly 98% have un-insulated walls (DECC, 2012); the number of solid wall installations is particularly disappointing. To meet the ambitious carbon reduction targets set by Government in the Climate change Act, almost all such dwellings will need to be upgraded, yet while ploughing through literature, it struck me how little we actually know about the existing housing stock, and in particular pre-1919, solid walled dwellings. The STBA (May, 2012) highlight the lack of knowledge and the potential increased risk for unintended consequences to occur with damage to the building fabric, if we are not careful. Gauging from industry interest in my own PhD research on pre-1919 suspended timber ground floor heatloss and insulation measures, I am aware that industry will need answers much faster than the time it takes to collect evidence. Perhaps the slow green deal uptake is a blessing in disguise? Rather than rolling out measures on a large scale, there is the benefit of a slower uptake to learn lessons and for industry and academia to collect evidence of associated risks and how to minimise them. References: CROWN 2008. Climate Change Act 2008: Elizabeth II ( Chapter 27) 2008. Great Britain: The Stationary Office Limited. DECC 2012. Statistical release: Experimental Statistics; Estimates of home insulation levels in Great Britain: January 2012. In: CHANGE, D. O. E. C. (ed.). London: Department of Energy & Climate Change. MAY, N., RYE C 2012. Responsible Retrofit of Traditional Buildings. A report on existing research and guidance with recommendations by STBA. This blog post is inspired by an email from Stewart Gilmour, CIBSE Director of finance and Services, quoting the Chief executive of the Green Deal Finance Company (GDFC) Mark Bayley who said the interest rate was very competitive already: “If you take a typical finance for a boiler over several years, you are looking at 19% and ours is less than 9%.” Compared to the Bank of England base rate of 0.5%, 9% does not sound competitive at all, does it? In Germany, a similar 'pay as you save' scheme as the Green Deal was hugely successful with the energy-efficient improvement of about 1 million existing homes between 2006-2009. It achieved this with low interest (subsidised) loans and performance targeted subsidies (full report by UCL Energy Institute and LSE here). The interest rate was 3-5% fixed rate for ten years, and no early redemption penalties. Given the high quoted Green Deal interest rates and the difficulty to get a Green Deal Finance Plan, we decided to try to finance our GD interventions another way (i.e. part savings, part personal loan). We cannot remortgage before 2016 as we are in a fixed rate, so we cannot release 'cheap' money this way like some others can; nor does our bank offer a low interest rate loan for energy efficiency improvements, as offered by Nationwide at below 3% interest rate for existing mortgage holders. Yet Bayley may not have been so incorrect stating that the 9% rate is "competitive". While many advertised bank loan rates are around 5-6% (assuming good credit; more like 14-15% with fair credit); the less money you borrow, the higher the interest rate. For example, if you do not hold a Nationwide mortgage and are borrowing with a standard personal loan instead; < £5000 from Nationwide will attract 11.9% interest; while between £5000 and < £7500 this is 8.9% and the lower advertised rate of 4.9% does not kick in until you borrow > £7500. Most loans work this way. And these are quite good rates for small amounts of money, for example the Bank of Scotland's rate for < £5000 is as much as 19.5%; though the cheapest I could find for this amount was Zopa (peer to peer lending) with 6%. With personal loans, the payback is usually ≤ 5 years, while for the Green Deal this can be spread over a longer term, with a minimum of 10 years, ofcourse building up proportional interest accordingly (see later). As this is paid back through the energy bills, selling your house would in effect pay off 'your' loan, by passing it to the next homeowner with the house sale, unless you need to pay it off early to find a buyer; there are likely to be early repayment redemption penalties for GD loans. Example 6, courtesy of DECC*, below highlights that repaying £3900 over 25 years at an assumed interest rate of 7.9%, will result in a total cost to be paid back of around £9000, with £362 annual repayments, or around £30 per month. However, if you can afford a higher repayment of £85 per month, you are better off taking the Nationwide loan, even at nearly 12%, as you'd paid back a total of £5100 after 5 years for the initial borrowed £3900. So, is the 9% Green deal rate competitive? Depends how you look at it and what other access to money you have and how much you can afford to repay each month. It is indeed a good thing that there are other incentives to bring costs down for those on low incomes. As our Green Deal Assessor said at her visit: "you may find that borrowing under the Green Deal Finance Plan is not the best way to fund the improvements, so look around." This advice is sound, it seems!

* As stated on first page; these examples are for information only and not for financial advice. All 6 examples below. A quick update: the third installer called me earlier in the week to see if we wanted to go ahead. I reminded them that in addition to some more detail on their quote we still had not received any ECO-funding offer.

They - surprisingly - told me that I should get this through the provider, not them. I told them that this is not what other installers have done; nor what I understand needs to be done, and that I was asked for the EPC.Xml file for them to work it out. They called me again today saying that the EPC.xml file - which I sent more than 2 weeks ago - does not seem to work with their IT system and would I mind that they would come and do another Green Deal assessment, free of charge? I told them they were welcome to do so, but that it likely would be a waste of their time: we received a good quote from installer 1; who can also do the roof for us and we are looking to work with them. I also told them the quote is only valid till the end of the month, and I was not confident they could give us a quote in time. They decided to not proceed with another assessment. I politely gave them some more constructive feedback about their process, but I am not sure how much this was appreciated! An update is long overdue. In the past 12 weeks I have met with DECC and have had 3 installers over the floor (one of them 3 times even) and received one quote with an idea of ECO-funding available and am due to receive another this week. I will cover all of this in a separate blog update, hopefully early next week.

Firstly to keep you updated on my meeting with DECC: The DECC Green Deal Team were genuinely interested in my experience as a consumer. I was impressed how the team knew the policy backward and forward and really took their time to listen and answer questions. They clearly have put a lot of work in. We went through the main points - as also raised in my earlier blogs and summarised below. One of the main points of discussion was that the Green deal is a market based policy: it is up to the installers to decide how the market should work and how they respond to consumer demand. For example, if an installer demands to undertake a new GDAR, not accepting the existing one, or is slow to respond and cannot offer ECO-funding or any other competitive advantage, they obviously increase the hassle factor and may not attract consumers. The DECC team made it clear the GDAR is meant to be portable, but that some companies are taking a different approach to this and interpreting issues of liabilities differently. Linn Rafferty also discusses this here. However, I have since also come to understand another reason why installers undertake a new GDAR: to determine ECO-funding related to the energy provider they are teamed up with. The standard GDAR done for me in March does not indicate any level of ECO-funding that may be available. It seems that installers working with EON as provider have to do a GDAR linked to their provider's system as this will then automatically tell them what ECO-funding this attracts. I will however come back to this in a follow-on blog once I get a second quote in, hopefully this week. DECC are also aware that the software tool is not ideal to predict energy savings pre-and post retrofit, but that this is an implication due to the EPC linking DECC also said that while each provider may be looking to provide ECO funding to the ‘lowest hanging fruit’ first; i.e. large housing schemes and electrically heated properties; at one point they will need to move onto individual households and more difficult to retrofit properties due to the nature of the ECO policy/carbon reduction obligations, which is in place until Spring 2015. It also means that each provider has its own strategy and therefore level of ECO-funding they offer, based on their business strategy. This is reflected by the different ECO-funding available depending on who is the installer/provider. It may also explain the ever-changing nature of what providers may offer, depending on how close the 2015 date approaches and in how far obligations have already been met or not. With regards to the EST Green Deal helpline ESAS and their rather wrongful and unhelpful advise when I called them, DECC said that they previously had made cold calls to quality check the information going out and said they might do it again. DECC were also particularly interested in the answers given by some of the installers/providers and made it clear that all systems are in place, but that companies seem to blame government if companies are delayed in offering finance. The Green Deal team were also keen to make the consumer process smoother; we discussed my suggestion for automatic linking or upload of the GDAR and an easier, partly automated system to send emails out to potential providers rather than contacting each one separately. I agreed to keep them posted on progress and I have been in touch with them on an on-going basis. Summary of issues I brought to DECC:

The DECC Green Deal team have kindly been in touch after spotting my tweets and blog. I have agreed to put feedback together from a GD occupant perspective and they have generously invited me to meet with them next week. (So any other occupants out there, feel free to contact me about the good and the bad) DECC stated that: " … we have been doing all we can to work with Green deal Providers to help them enter the market as quickly as possible. The Green Deal is a market based mechanism. Whilst Government is responsible for putting in place the legislative and supporting frameworks to enable delivery, we are reliant on the private sector to come forward and offer green deal assessments, Plans and measures to consumers." The letter goes on to state that : "There are 48 companies registered as Green deal Providers and The Green Deal Finance Company stands ready to provide finance to them. Of these 48 companies, some are more advanced than others in terms of their own systems and readiness to deliver." Of the 40 providers I contacted, around 55-60% responded. Of those who may offer individual households finance, they said that the software is not yet ready. The good news however is that DECC state that " .. we are aware that some companies are already offering ECO funding to support the option of solid wall insulation in individual households". This is good news, and DECC have - with my agreement- passed on my details to 2 companies, "who should be in touch shortly". Interestingly, I have also been contacted by another occupant, who is trying to find a Green Deal installer with ECO access, (no need for finance) and he has been unable to find someone too. He works in the building industry so he has been trying to use his insider knowledge and contacts to negotiate and find willing 'ECO' installers. This process is obviously not repeatable for those outside the industry, and just adds to uptake barriers and hassle. Finally, the DECC letter also says that ESAS (Energy saving advice Service 0300 123 1234) is:"...currently in the process of updating its advice to better reflect the status of different Providers and readiness to go to the market. ESAS is therefore the referral menchanism for those seeking a provider…". However, I did contact ESAS in April, before the DECC letter arrived and all they could do was take my details so DECC can give me a list of Providers who are ready as they do not have that list. They told me it would take 7-10 days to hear back with this information. So far, I have had more luck with direct DECC contact as I have not heard anything yet, though this is rather an unusual route and not really what I am meant to do. ESAS also told me (incorrectly) that all ECO-funding is means-tested and "only for people on certain benefits". When I read out a phrase from their own leaflet and Ofgem's website to contest this statement, ESAS then read out a standard statement stating the 3 parts of ECO (i.e. ECO Affordable Warmth; ECO Carbon Saving and ECO Carbon Saving Communities), to then agree that for ECO Carbon Saving, residents do not need to be on benefits to be eligible. Let's hope that this misinformation is due to early teething-problems, but I pointed out that it is crucial that ESAS give correct and consistent information to the consumer, particularly as in the information leaflet provided by the Green Deal Advisor it clearly directs consumers to them for advice on ECO-eligibility. I have also received a request from DECC for feedback via an online survey ( and £10 voucher to encourage me to do so). It is a long and detailed survey, but - if returned en masse by Green Deal occupants - will give insights to motivations for the Green Deal, assessment experience and identification of uptake barriers of approved measures. It is hoped that each occupant will fill this in as it will be useful feedback.

"Our clients are the ones paying our salaries – so how do they see us? Terry Wardle takes a look at how the work of Green Deal Advisers

is being reviewed in the media." --> A good blog (eventhough he describes me as "probably.... the client from hell"! An interesting quote from a journalist on allowing a Green Deal Advisor in her home: ‘A complete stranger is in my house asking me intimate details about my family’s showering and cooking habits and how many times we use the washing machine. She has even made a rough sketch of our bedroom. Pointing a laser beam at each external wall to gauge room dimensions, she casually asks if I put lids on the saucepans when I boil my vegetables. Who is this nosy individual I have let into my home?’ I don't touch much on the intrusion part in my blog below, as I had expected such occupant questions, but the above quote made me realise that it will take many people by surprise indeed and not all may feel comfortable about it or wonder why an assessor needs to know this. Terry also wrote a blog on the role of Green Deal Assessors - still pretty much up to date. As per Linn Rafferty's comment: "Assessor is the term used by the GD Oversight and registration body (GD-ORB, run by Gemserv) to mean the organisation providing the GD Advice Service (GDAS). Advisor is the human being who passed the GDA qualification, and actually visits the customer and provides the assessment and advice. So your visit was delivered by an Advisor working with an Assessor." On another note, I received (in my spam folder) an email from the BRE asking for feedback on the EPC assessment as this is registered with them. The survey asked a handful of general questions about the Adviser's conduct (did they show their badge upon entering; did they gain access everywhere etc). Ofcourse this separate email about the EPC feedback is likely to confuse the occupant who gets the EPC as a by-product of the Green Deal Assessment. I have relayed this feedback to the BRE. Today I received this comment from Katherine. I have posted it in its entirety. This is indeed worrying.

"Hi Sofie, I work for an installer - and I just thought to add a little from our side of things may be informative (though not actually helpful!). We have houses ready for funding, but no providers want to give full funding. We specifically targeted areas that were ECO eligible - you can look up the eligible areas, then search your postcode to see if it is in a "vulnerable" area. This should achieve 100% funding for Solid Wall Insulation - as it is by definition a "hard to treat" measure. However, when it comes down to the nitty gritty, the providers are constantly changing the goal posts. We are now told a property needs to be solid fuel AND solid wall - and even then may not achieve full funding. Personally, I can not see the point of ECO if they are not intending to use it for its purposes - to help the vulnerable insulate their homes. They are trying to "force" people into having Green Deal finance to top up the ECO grants. There is no mention of fuel types determining the eligibility for ECO, it just ticks more boxes and gives a bigger saving than a house on mains gas - but this is not why ECO was set up. Sorry, now I'm just rambling. Back to my point, even now, the providers are reluctant to give us even an idea of funding - so we are left not really knowing what to tell people, other than be patient, we are trying to get them the best deal we can. But I think you may have more luck with a smaller, local installer that has access to funding via providers. Though as you say, there is no easy way to find these. Very best of luck to you though." Added 4pm 15/04: It appears that providers are trying to look for the 'lowest hanging ECO fruits', i.e. the interventions giving the greatest carbon reductions for least amount of effort/money, which is indeed the Solid Walled (SW) and solid fuelled dwellings (and where many properties in one go can be treated). However, it is problematic if this is at the expense of ECO-funding properties that are SW and in vulnerable areas, simply because they are not solid fuelled. This will presumably cut out much or all of greater London properties, despite 30% being classified as SW properties, due to the smoke control zone and lack of solid fuelled properties,...Equally individual dwellings may not be able to access ECO-funding for several months or years until the low-hanging fruits are harvested first. It seems that individual householders may find it difficult - or impossible to access ECO funding, despite 'in theory' their properties qualifying. Unable to get access to the top-up funding required to undertake solid wall insulation to meet the Green Deal's Golden Rule, presumably means that they cannot undertake this Green Deal measure unless they are able to afford the difference. If this is the way things are going; ECO-funding might have been mis-advertised and householders might have been deceived. So, about one month on from sending out 40 queries to providers, I still have not received any finance plan; I have no idea what the costs would be for the approved Green Deal measures, nor what (if any) ECO funding is available, nor what cash-back incentive may apply - let alone have I had any measures installed. This is somewhat frustrating - to say the least.

I do wonder whether less engaged and motivated occupants may give up at this stage; the hassle factor is significantly increased having had an assessment done and then not being able to obtain any other information or having works done. If I had paid for the assessment and then being unable to proceed or knowing when I might be able to follow up on its recommendations, I would have felt I just wasted the assessment fee. Admittedly this lack of progress does not exactly instill confidence in the whole Green Deal process. A brief update below:

A few other things to update on/clarify, thanks to twitter and LinkedIn discussions and people leaving comments:

|

About SofieThis is Sofie's blog; or rather a collection of musings & articles sometimes also published elsewhere. More about Sofie here. Archives

April 2014

Categories

All

|

RSS Feed

RSS Feed